|

|

Simple spreadsheet model

Various models have been tested over the last couple of years, such as

trading based on the average VIX futures premium, standard deviation of

VIX changes, or the difference between VIX and actual volatility of the

S&P500. Historical

performance was great, but did not spill over into the present, when

the models were tested in actual trading.

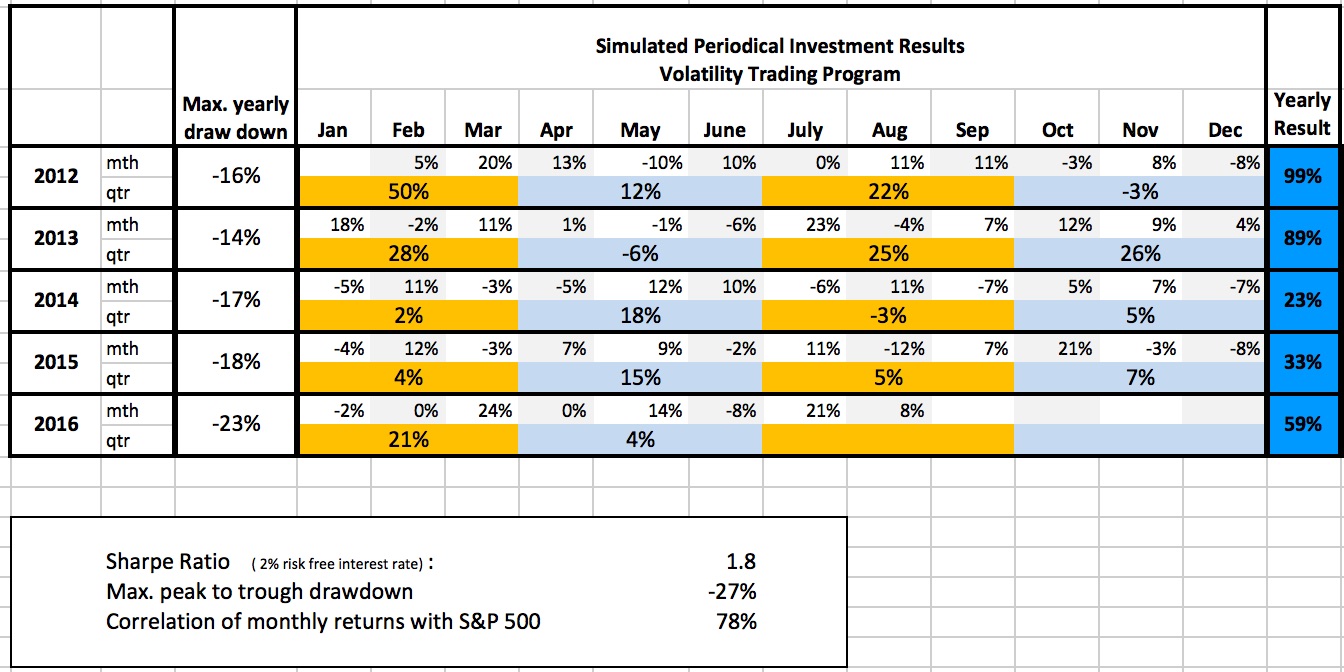

Below is a summary of the simulated historical performance of the

latest model. It needs to be tested in live trading. The model is

simpler than previous models, in the hope that this will protect

against overfitting. It is based on the strong erosion of the UVXY

value over time.

|

|